OUTSMART SCAMS

9 common scams and how to avoid them

Millions of people send money every day to cover bills, shop online, pay friends and family, and more. Payment and banking apps make sending money fast and convenient, but where there’s money, there are scams.

Scams can happen to anyone. It can be difficult to tell what’s real or not because scammers are constantly coming up with different types of scams to steal your money. To protect yourself and your money, get to know the most common scams so that you can spot them right away.

1. Catfishing scams

One of the most common scams on social media is known as a catfishing scam, where scammers use a fake online identity to start relationships, usually romantic or emotional ones, with people who think they’re talking to a real person.

They want to win your trust so they can take advantage of it. Over time, scammers can slowly collect personal info about you or develop a relationship they can use to ask you for money.

How to spot catfishing scams and avoid them

- Be careful with online relationships, especially with people you’ve never met in real life.

- Don’t send money to people you haven’t met, even if they have a convincing story.

- See if the person will join a video call or answer specific questions about themselves. If they say no or have inconsistent responses or appearances, it could be a scam.

- Look up the person’s profile photo by searching for it online. If the same picture shows up elsewhere with a different name, that’s a sign the photo could be stolen.

- Ask close friends or family if they think anything seems suspicious about the relationship.

2. Survey scams

Fake surveys are common scams that trick people into providing sensitive personal info online. They often start with an email or message on social media that seems like it’s from a real company asking you to participate in a survey.

Before you can take the survey, you might be asked to buy something, make a small payment, or add personal details, like your Social Security number or birthday. If you do, scammers can sell your info or use it to access your accounts.

How to spot survey scams and avoid them

- Don't click on links from people or places you don’t recognize.

- Scammers often use hacked or imposter accounts to pretend to be someone you know, so look out for messages that don’t seem right.

- In general, real surveys will never ask you to buy something, make a payment, or share your personal or financial information to participate.

- Look out for bad grammar and spelling mistakes. Like many common scams, this is usually a sign that something isn’t real.

- Fake surveys on social media can require email addresses or phone numbers to submit the survey, and they’ll use your contact info later for an unrelated scam.

3. Giveaway scams

Giveaway scams promise big prize payouts, usually for a small fee. These common scams usually come from an email or social media post promising a big, limited-time giveaway of cash or expensive products.

They can look convincing because scammers will include the name and logo of a real company or government agency. To claim your prize, you have to pay a small “verification” or “processing” fee, or you’ll be tricked into giving personal info that scammers use to steal your identity.

How to spot giveaway scams and avoid them

- Double-check that it’s real. If you see a giveaway on social media, make sure the account is verified, not a new account.

- If you receive an email, check the “from” address to see if the domain matches the actual company or organization.

- Like with other types of scams, pay attention to bad grammar or misspelled words.

- Don’t send money or share personal info hoping to get a prize that sounds too good to be true.

4. Money flip scams

Money flip scams have been around forever, online and in real life. A scammer promises to turn a small investment into big money through some secret technique. They’re frequently found in social media posts or direct messages.

To get your attention, scammers claim they can “flip” your cash for “guaranteed returns” or “quick profits” to get your attention. They usually start by asking for a small amount of money, and they’ll appear to “flip” your cash for a profit to build trust and get more of your money. After that, they ask for a larger investment for a bigger return, then ultimately disappear with your money.

How to spot money flip scams and avoid them

- Remember that if a promise sounds too good to be true, it probably is, especially when it comes to money.

- Scammers may claim that they know a “system glitch” which allows them to flip your money into larger amounts.

- Avoid sending money to people you don’t know for things you might not fully understand.

- If the post or message on social media has bad grammar or spelling mistakes, don’t trust them with your money.

5. Apartment or rental deposit scams

In this type of scam, scammers trick people into paying a deposit or first month’s rent on an apartment or house that isn’t available. They usually create a convincing ad with a low price that generates a lot of interest.

Before you see the place, scammers pressure you into paying a deposit, oftentimes through a wire transfer or another unusual method. After you send the money, the scammer disappears, and you’re left without a place to live.

How to spot apartment or rental deposit scams and avoid them

- Always visit an apartment or home in person before paying any type of deposit or rent.

- Watch out when a property manager or owner claims they can’t show you the property. They might not actually be connected to the apartment or home.

6. Customer support impersonators

Scammers pose as customer support from a bank and say there’s a problem with your account, but they’re after your account details or personal info.

They might ask you to call a fake support number, click on a fake link, or perform a “test” transaction to get your PIN, password, or sign-in code. It’s common for them to say your account is locked, and you need to verify something to unlock it.

How to spot customer support impersonator scams and avoid them

- If you’re contacted by someone claiming to be from customer support and it feels weird, hang up.

- Double-check that the email, call, or text comes from a number that belongs to the company. You can usually do this by searching online.

- Remember that real customer support representatives will never request personal info, especially your password.

- If you don’t have an account with the company a scammer claims to be from, don’t respond. If they call and something seems wrong, you can let the person know that you’ll call them back on the company’s official phone number.

7. App glitch

By tricking people into downloading a fake app, scammers can steal your username and password. For example, a scammer might claim there’s a Cash App glitch that requires you to download a different version of Cash App that they send to you.

When you log into the fake app, they steal your info so they can get into your real account and access your money.

How to spot app glitch scams and avoid them

- Only download apps from Apple’s App Store or Google Play.

- Don’t trust download links from websites you haven’t heard of or files sent in text messages.

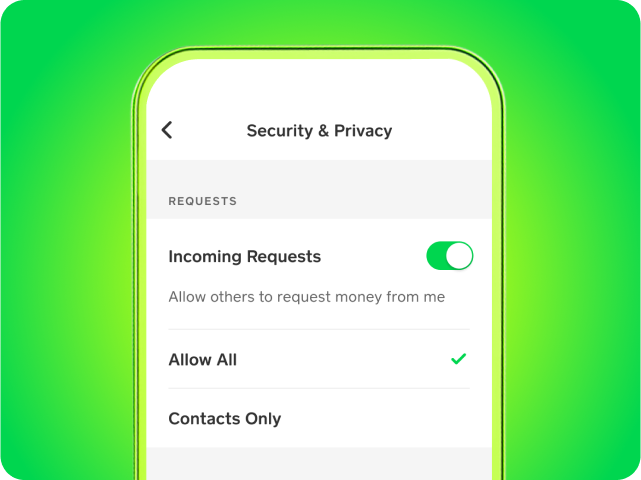

- Turn on Security Lock in your Cash App settings.

- If you think someone has your login info, go to your Cash App Security & Privacy settings to log out of any devices that aren’t yours.

- Use a unique password for each financial and social media account.

8. Pet deposit scams

Scammers post cute photos and stories to get you to put down a deposit for a pet, but it’s all made up to steal your money.

These scams often look like a breeder is advertising puppies or kittens for sale. They ask for an upfront payment, often through a banking app or wire transfer, to reserve your pet. Once you pay, they disappear, and you never get a pet.

How to spot pet deposit scams and avoid them

- Never pay for a pet you haven’t seen in person.

- Be suspicious of sellers who won’t arrange a face-to-face meeting.

- Always research the seller or breeder. Check business profiles on sites like the Better Business Bureau. If you can’t find any info on the breeder, it’s a red flag.

- Search for the image of the pet being advertised. Scammers often reuse the same pet photo.

9. Accidental payment scams

In accidental payment scams, a scammer sends you a message claiming they sent you money by mistake and asks for it back.

Sometimes, they didn’t even send a payment. If they did send you a payment, they often use stolen card info to send you the money. If you pay them, they transfer your money to their own account and keep your money.

How to spot accidental payment scams and avoid them

- Only send money to people you know.

- Block payment requests on Cash App from people who aren’t in your contacts.

- If you receive a suspicious payment, ask them to cancel the transaction instead. If they won’t, it’s probably a scam.

- In case it’s actually a mistake, issue a refund rather than sending a new payment with your money.

Avoid common scams with Cash App

There are a lot of common scams out there, but Cash App puts your security first to help you avoid them. Remember that we’ll never ask for sensitive information, like your PIN or login code by phone, email, or text.

To keep your money safe, remember to turn on Security Lock in the app by going to your Security & Privacy settings. This will require your face, fingerprint, or PIN to move money or unlock the app and add an extra layer of security to your account.

If you ever get a suspicious message, take a minute to check if the message is real, especially if it claims to be from your bank, Cash App, or anything related to your money. If an offer sounds too good to be true or a situation feels off, there’s a good chance it’s a scam.